CHARLOTTE MORTGAGE EXPERTS

Here at On Point Home Loans, you don’t just get a mortgage- you get a trusted partner dedicated to helping you achieve your homeownership dreams with confidence. We are local mortgage brokers with nationwide access to 150+ lenders and 40+ loan programs, ensuring you get the best possible rate and terms for your mortgage. Instead of spending hours shopping banks, we do the heavy lifting—saving you time, stress, and money. We would love to chat and earn your business!

MEET YOUR PERSONAL LOAN ADVISOR NOW >>>

What Is a Fix and Flip Loan?

A Fix and Flip Loan is a short-term real estate financing option that provides investors with the funds to purchase, renovate, and resell properties for profit. Unlike traditional mortgages, which are designed for long-term homeowners, Fix and Flip Loans in Charlotte NC focus on the property’s after-repair value (ARV) rather than the borrower’s income alone.

These loans are ideal for real estate investors, contractors, and developers who need fast, flexible capital to move quickly on opportunities in Charlotte’s competitive housing market. Whether it’s a cosmetic remodel or a full renovation project, fix and flip financing helps investors turn distressed homes into high-value resale properties.

With On Point Home Loans, you gain access to fast approvals, flexible draw schedules, and competitive investor rates—empowering you to manage renovations efficiently and scale your investment business.

How Fix and Flip Loans Work in Charlotte, NC

Fix and Flip Loans in Charlotte NC are designed for real estate investors who need short-term, project-based financing to acquire and renovate properties for resale. These loans emphasize the after-repair value (ARV)—the estimated worth of the property once renovations are complete—rather than the borrower’s personal income.

Here’s how the process works:

- Property Evaluation – The lender assesses the property’s current value and projected after-repair value (ARV) based on your renovation plans.

- Loan Approval and Funding – Once approved, funds are issued quickly—often within 7–14 days—to help investors act fast on property purchases.

- Draw Schedule Setup – Funds for renovation are released in stages (draws) as work progresses and inspections confirm project milestones.

- Interest-Only Payments During the Term – Borrowers only pay interest on the amount drawn, reducing upfront financial pressure during construction.

- Sale or Refinance Upon Completion – Once the property is renovated, you can sell for profit or refinance into a long-term mortgage to retain it as a rental asset.

With Charlotte’s strong housing demand and growing investment opportunities, a fix and flip loan from On Point Home Loans gives you the leverage and speed needed to turn projects into profitable returns.

Is a Fix and Flip Loan Right for You?

A Fix and Flip Loan could be the right financing solution if you’re an investor who wants to quickly acquire, renovate, and sell properties for profit in Charlotte, North Carolina. Unlike conventional loans, these programs focus on the project’s potential—not just your credit or income—making them ideal for experienced and new investors alike.

You might find a Fix and Flip Loan in Charlotte NC ideal if you:

- Regularly buy and renovate residential properties to resell at a higher value.

- Have an eye for undervalued homes in Charlotte’s fast-growing real estate market.

- Want flexible financing that allows fast closings and staged renovation draws.

- Need a short-term funding solution without traditional income documentation.

- Prefer working with a local lender who understands North Carolina’s property trends and investor needs.

Fix and Flip Loans provide the agility and financial backing needed to move quickly in today’s competitive real estate landscape—helping you maximize returns and scale your investment portfolio.

You May Be a Great Fit for a Fix and Flip Loan If You

Invest in Residential Real Estate in Charlotte NC

You focus on buying and renovating single-family or small multifamily properties in Charlotte’s competitive housing market.

Have Experience in Property Renovation or Construction

You’re an investor or contractor familiar with budgeting, managing timelines, and overseeing renovation projects.

Need Fast Access to Capital

You want quick funding and flexible draw schedules to start your flip project without delays.

Focus on Short-Term Projects with High ROI

You plan to renovate and resell properties within 6–12 months, maximizing profits and reinvesting quickly.

Prefer Interest-Only Payments During the Loan Term

You value lower monthly payments while your funds are tied up in property improvements.

Work with Local Experts Who Understand Charlotte’s Market

You want guidance from On Point Home Loans, a Charlotte-based fix and flip lender that knows regional pricing, permitting, and investment trends.

What our clients say

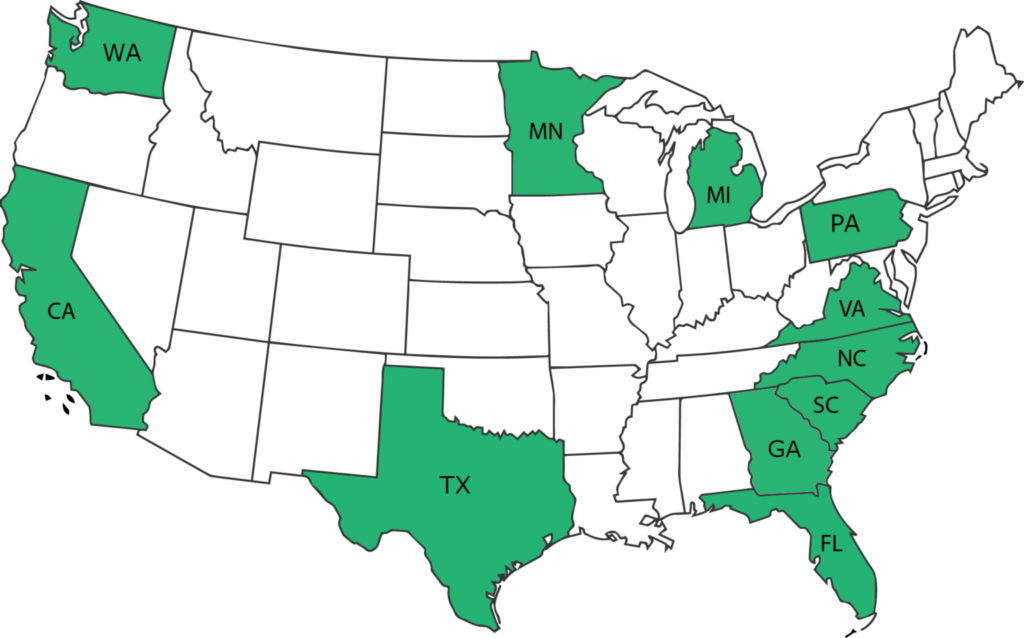

We Are Licensed In

Currently Licensed In

Coming Soon