CHARLOTTE MORTGAGE EXPERTS

Here at On Point Home Loans, you don’t just get a mortgage- you get a trusted partner dedicated to helping you achieve your homeownership dreams with confidence. We are local mortgage brokers with nationwide access to 150+ lenders and 40+ loan programs, ensuring you get the best possible rate and terms for your mortgage. Instead of spending hours shopping banks, we do the heavy lifting—saving you time, stress, and money. We would love to chat and earn your business!

MEET YOUR PERSONAL LOAN ADVISOR NOW >>>

What Is a Conventional Loan?

A Conventional Loan is a traditional mortgage not insured by the federal government, making it one of the most popular financing options for homebuyers with stable income and good credit. Unlike FHA, VA, or USDA loans, Conventional Loans in Charlotte NC are backed by private lenders and typically conform to Fannie Mae and Freddie Mac guidelines.

These loans are ideal for borrowers who want low rates, flexible loan terms, and more property options—without the extra cost of government-backed insurance. They can be used for primary residences, vacation homes, and investment properties, giving Charlotte buyers greater flexibility in how they use their financing.

With On Point Home Loans, borrowers benefit from:

- Low down payment options starting at just 3% for qualified buyers.

- Fixed or adjustable-rate mortgages (ARMs) tailored to their budget and goals.

- No upfront mortgage insurance premiums, helping reduce closing costs.

For homebuyers in Charlotte, North Carolina, a Conventional Loan offers a balance of affordability and freedom—perfect for those ready to invest confidently in long-term homeownership.

How Conventional Loans Work in Charlotte, NC

Conventional loans are straightforward, flexible mortgage options that follow established lending standards set by Fannie Mae and Freddie Mac. These loans are widely available and cater to borrowers with good credit, stable income, and manageable debt levels.

Here’s how the process works for Charlotte homebuyers:

- Prequalification and Credit Review – Your lender evaluates income, credit score, and debt-to-income ratio. Most conventional loans require a minimum credit score of 620.

- Down Payment Options – You can buy a home with as little as 3% down for first-time buyers or 5% for repeat buyers. Higher down payments often unlock better interest rates.

- Private Mortgage Insurance (PMI) – If you put less than 20% down, PMI is required. However, PMI can be canceled once your home equity reaches 20%.

- Loan Limits – In Mecklenburg County (Charlotte), 2025’s conforming loan limit is around $766,550 for a single-family home. Jumbo loan options are available above this limit.

- Flexible Terms – Choose from fixed-rate or adjustable-rate options, with repayment terms ranging from 10 to 30 years.

Because they’re not government-insured, Conventional Loans in Charlotte NC offer more flexibility with property types and fewer restrictions. With On Point Home Loans, you’ll get personalized guidance to secure the most competitive rate and terms for your financial profile.

Is a Conventional Loan Right for You?

A Conventional Loan may be the right choice if you’re a Charlotte homebuyer with solid credit, steady income, and a plan for long-term homeownership. Unlike government-backed loans, conventional financing gives borrowers greater flexibility, fewer restrictions, and the potential to eliminate mortgage insurance faster.

You might find a Conventional Loan in Charlotte NC right for you if:

- You have a credit score of 620 or higher and a consistent employment history.

- You want competitive interest rates and customizable loan terms.

- You can make at least a 3% down payment (or more to lower your monthly cost).

- You’re buying a primary residence, second home, or investment property in Charlotte or nearby areas.

- You prefer a loan option that lets you remove mortgage insurance once equity reaches 20%.

- You want to refinance an existing loan to lower your rate or monthly payment.

With On Point Home Loans, you gain access to expert guidance, local market insight, and flexible conventional loan programs designed to help Charlotte buyers build equity faster and with confidence.

You May Be a Great Fit for a Conventional Loan If You

Have Strong Credit and Steady Income

You maintain a credit score of 620 or higher with reliable income, making you eligible for competitive conventional mortgage rates in Charlotte NC.

Can Provide a Down Payment of 3% or More

You’re prepared to make a small to moderate down payment, allowing you to access low-cost home financing without government restrictions.

Want to Avoid Long-Term Mortgage Insurance

You prefer a loan where Private Mortgage Insurance (PMI) can be removed once you reach 20% equity, reducing monthly payments.

Plan to Stay in Your Home Long-Term

You’re buying a home in Charlotte NC with the intent to build equity and take advantage of stable, fixed-rate financing.

Want Flexibility in Property Type

You’re purchasing a primary home, vacation property, or investment home, and want a loan option that covers all three.

Prefer Local Expertise and Personalized Service

You want guidance from On Point Home Loans, a Charlotte-based lender that tailors conventional loan programs to fit your long-term financial goals.

What our clients say

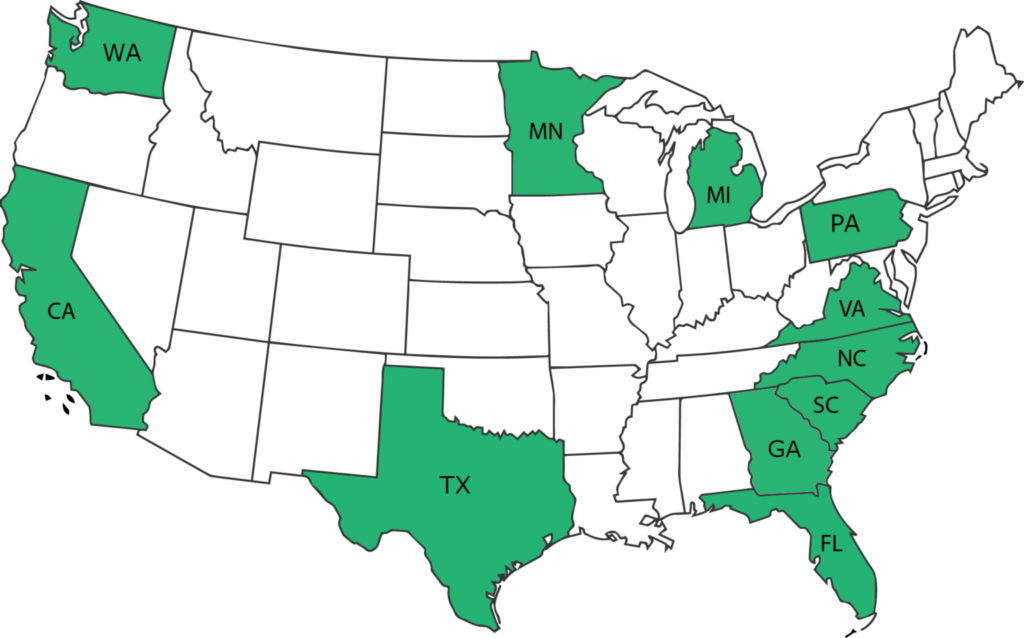

We Are Licensed In

Currently Licensed In

Coming Soon