CHARLOTTE MORTGAGE EXPERTS

Here at On Point Home Loans, you don’t just get a mortgage- you get a trusted partner dedicated to helping you achieve your homeownership dreams with confidence. We are local mortgage brokers with nationwide access to 150+ lenders and 40+ loan programs, ensuring you get the best possible rate and terms for your mortgage. Instead of spending hours shopping banks, we do the heavy lifting—saving you time, stress, and money. We would love to chat and earn your business!

MEET YOUR PERSONAL LOAN ADVISOR NOW >>>

More than 50 years’ experience

What Is a Fix and Flip Loan?

A fix and flip loan is a short-term real estate investment loan designed to help property investors in Charlotte, NC quickly purchase, renovate, and resell homes for profit. These loans offer fast funding, flexible credit guidelines, and interest-only payment options, making them ideal for house flippers, real estate investors, and contractors seeking to leverage under-market properties.

At On Point Home Loans, we provide tailored fix and flip financing with quick approvals and local expertise to help you capitalize on renovation opportunities and maximize return on investment.

What Is a Construction Loan?

A construction loan is a short-term, specialized mortgage that covers the cost of building or renovating a home from the ground up. Instead of receiving one lump sum, the borrower receives funds in stages-called draws-that correspond with each phase of the project.

In Charlotte, NC, construction loans from On Point Home Loans allow homebuyers, investors, and builders to finance land, materials, labor, and permits with a single, convenient solution. Once construction is complete, the loan can easily convert into a permanent mortgage, saving you time, paperwork, and money.

What Is an FHA Loan?

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration, created to help buyers with low credit scores, limited income, or small savings purchase a home. FHA loans are especially popular among first-time homebuyers in Charlotte, NC, because they offer flexible qualification guidelines and a low 3.5% down payment option.

Unlike conventional loans, FHA loans are designed to be more accessible – making them a smart option for buyers who might not qualify elsewhere. Backed by the federal government, FHA loans give lenders confidence to approve borrowers with credit scores as low as 580, while offering competitive interest rates and the ability to use gift funds toward down payments and closing costs.

What Is a Investor Construction Loan?

An Investor Construction Loan is a short-term financing solution designed for real estate investors who are building or renovating properties for resale or rental income. Unlike traditional homeowner construction loans, investor loans focus on the project’s potential value and profitability, not just personal credit. With On Point Home Loans, Charlotte investors can access flexible draw schedules, interest-only payments during construction, and funding tailored to new builds, fix-and-flip projects, and multi-unit developments across North Carolina. These loans help investors leverage equity, maintain cash flow, and complete projects faster in a competitive housing market.

What Is a Non-QM Loan?

A Non-QM (Non-Qualified Mortgage) loan is a flexible home financing option designed for borrowers who may not meet traditional mortgage requirements. If you’re self-employed, have irregular income, own multiple businesses, or need alternative documentation – a Non-QM loan in Charlotte, NC can help you qualify for the home you want without the strict rules of conventional loans.

Unlike standard loans backed by Fannie Mae or Freddie Mac, Non-QM loans use alternative income verification, such as bank statements, 1099s, asset-based lending, or rental income – making them ideal for real estate investors, gig workers, and business owners.

At On Point Home Loans, we help Charlotte-area buyers unlock homeownership with custom Non-QM mortgage solutions tailored to your unique financial profile.

What our clients say

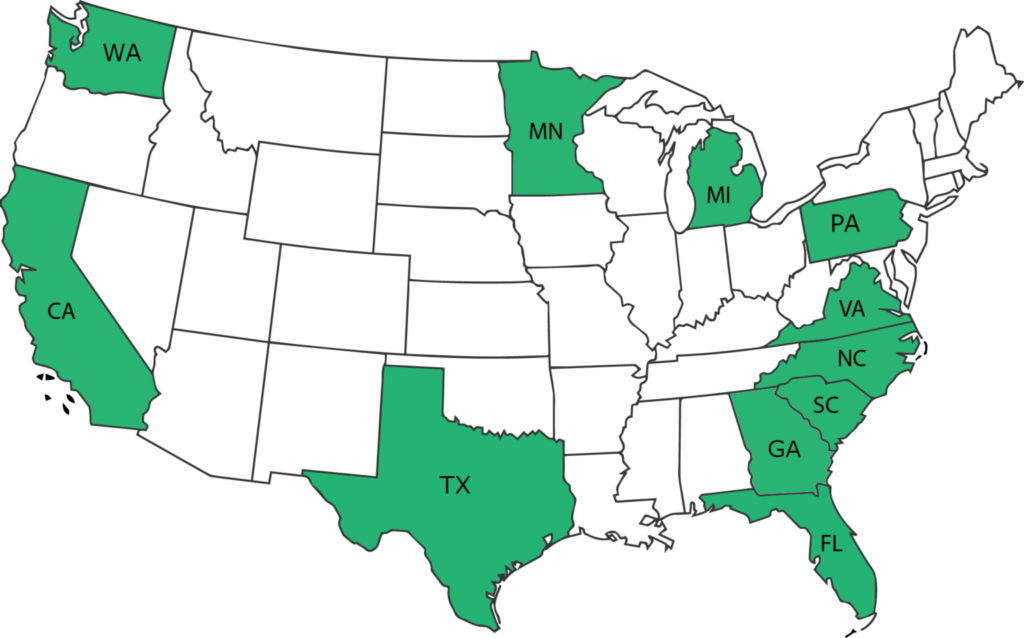

We Are Licensed In

Currently Licensed In

Coming Soon