CHARLOTTE MORTGAGE EXPERTS

Here at On Point Home Loans, you don’t just get a mortgage- you get a trusted partner dedicated to helping you achieve your homeownership dreams with confidence. We are local mortgage brokers with nationwide access to 150+ lenders and 40+ loan programs, ensuring you get the best possible rate and terms for your mortgage. Instead of spending hours shopping banks, we do the heavy lifting—saving you time, stress, and money. We would love to chat and earn your business!

MEET YOUR PERSONAL LOAN ADVISOR NOW >>>

What Is an FHA Loan?

An FHA loan is a government-backed mortgage program insured by the Federal Housing Administration (FHA). It’s designed to make homeownership accessible for first-time buyers, individuals with limited savings, or borrowers with moderate credit scores.

Unlike conventional loans that demand higher credit and larger down payments, FHA loans in Charlotte NC allow qualified borrowers to buy a home with as little as 3.5% down and credit scores starting at 580. The FHA’s insurance protects lenders against default, which means more flexible approval terms for borrowers.

This loan type is ideal for:

- First-time homebuyers in Charlotte looking for low upfront costs.

- Borrowers rebuilding credit or recovering from financial challenges.

- Families and individuals seeking stable, fixed-rate financing options.

With On Point Home Loans, you gain access to local FHA loan specialists who understand Charlotte’s housing market, property values, and FHA appraisal standards—ensuring a smooth and fast path to homeownership.

How FHA Loans Work in Charlotte, NC

FHA loans operate by combining flexible qualification standards with government-backed mortgage insurance, making them ideal for first-time homebuyers and credit-challenged borrowers in Charlotte, North Carolina.

Here’s how the process works:

- Prequalification and Credit Review – FHA lenders assess your credit score, debt-to-income ratio, and overall financial profile. Borrowers with scores as low as 580 can qualify with 3.5% down, while those between 500–579 may still qualify with 10% down.

- Property Appraisal – The home must meet FHA safety and habitability standards, ensuring it’s move-in ready and meets Charlotte housing guidelines.

- Mortgage Insurance – All FHA loans require Mortgage Insurance Premiums (MIP) to protect lenders and maintain program accessibility for more borrowers.

- Loan Approval and Closing – After verification, your lender finalizes the loan and funds your purchase—usually within a few weeks.

- With FHA loans in Charlotte NC, buyers enjoy lower down payments, competitive rates, and more lenient credit requirements—making it one of the most accessible home financing options in today’s market.

On Point Home Loans helps local residents navigate FHA loan qualifications and ensures a seamless experience from application to closing.

Is an FHA Loan Right for You?

An FHA loan could be the right choice if you’re a first-time homebuyer in Charlotte or someone who needs a mortgage option with flexible requirements and lower upfront costs. FHA loans are designed to make homeownership accessible for those who might not qualify for conventional financing due to credit challenges, limited savings, or variable income.

You might find an FHA loan in Charlotte NC right for you if:

- You’re a first-time buyer with limited funds for a down payment.

- You have a credit score between 580–680 and want fair qualification standards.

- You prefer a fixed-rate mortgage with predictable monthly payments.

- You’re looking for competitive interest rates and flexible guidelines.

- You want to buy or refinance a primary residence in the Charlotte metro area.

Because FHA loans are backed by the Federal Housing Administration, lenders can offer more accommodating terms—giving Charlotte borrowers an affordable path to owning or refinancing their home.

You May Be a Great Fit for an FHA Loan If You

Are a First-Time or Repeat Homebuyer

You’re ready to buy a home in Charlotte NC but prefer flexible qualification requirements and low upfront costs.

Have a Moderate Credit Score

FHA loans accept borrowers with credit scores as low as 580, making them a great option for those rebuilding credit.

Need a Lower Down Payment Option

You want to purchase a home with as little as 3.5% down, freeing up savings for closing costs or home improvements.

Want to Refinance for Better Terms

FHA refinance programs allow Charlotte homeowners to lower interest rates, adjust loan terms, or access home equity easily.

Have Steady Income but Limited Savings

You maintain consistent income but don’t have a large down payment or reserve fund for a conventional loan.

Prefer Guidance from a Local FHA Specialist

You value expert assistance from On Point Home Loans, a Charlotte-based lender experienced in FHA loan programs and North Carolina’s housing market.

What our clients say

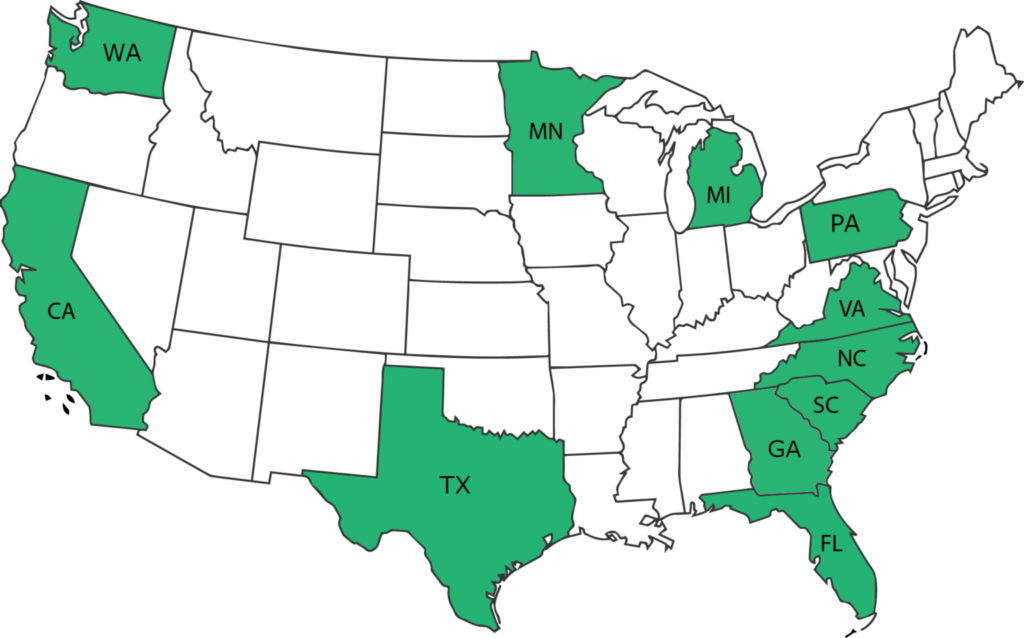

We Are Licensed In

Currently Licensed In

Coming Soon